All Categories

Featured

Table of Contents

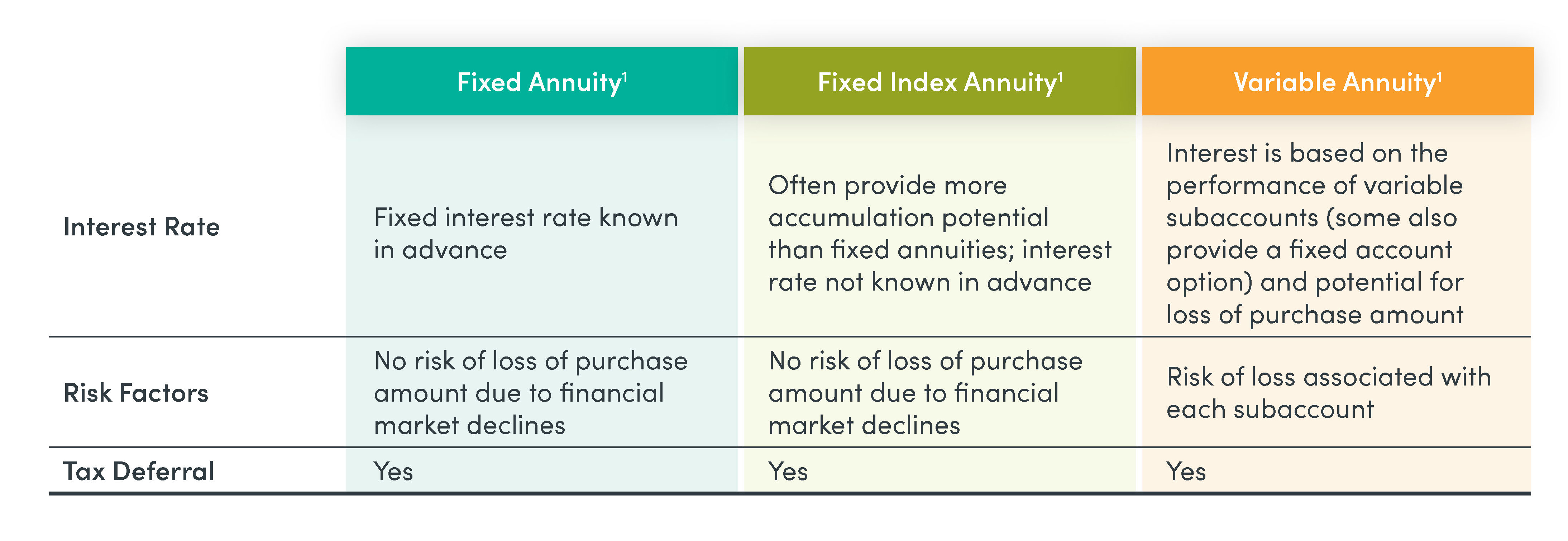

Your payments will certainly grow until you annuitize them and start taking payments. Dealt with or variable growth: The funds you add to delayed annuities can grow gradually. Typically, you can select exactly how they grow. With a repaired annuity, the insurer establishes a specific percentage that the account will gain annually.

A variable annuity1, on the other hand, is frequently linked to the financial investment markets. The development might be greater than you would get at a set price. Yet it is not guaranteed, and in down markets the account could decline. No. An annuity is an insurance product that can help assure you'll never ever run out of retirement savings.

It's normal to be concerned regarding whether you have actually saved sufficient for retirement. Both Individual retirement accounts and annuities can assist reduce that problem. And both can be utilized to construct a robust retired life approach. Understanding the differences is vital to maximizing your cost savings and preparing for the retirement you are entitled to.

Annuities convert existing savings into assured settlements. If you're not certain that your financial savings will certainly last as long as you need them to, an annuity is a great means to minimize that worry.

On the other hand, if you're a long method from retirement, beginning an individual retirement account will certainly be useful. And if you've added the maximum to your individual retirement account and wish to put extra cash toward your retired life, a deferred annuity makes sense. If you're not sure regarding how to manage your future cost savings, an economic expert can aid you get a more clear photo of where you stand.

Highlighting Fixed Indexed Annuity Vs Market-variable Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Tax Benefits Of Fixed Vs Variable Annuities FAQs About Fixed Income Annuity Vs Variable Growth Annuity Common Mistakes to Avoid When Choosing Variable Vs Fixed Annuities Financial Planning Simplified: Understanding Variable Vs Fixed Annuity A Beginner’s Guide to Fixed Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

When taking into consideration retirement planning, it is essential to find an approach that best fits your lifefor today and in tomorrow. might help guarantee you have the revenue you need to live the life you desire after you retire. While fixed and repaired index annuities audio comparable, there are some essential distinctions to arrange through before choosing the appropriate one for you.

is an annuity contract designed for retired life earnings that ensures a fixed rates of interest for a specified time period, such as 3%, no matter market efficiency. With a set rate of interest price, you understand beforehand just how much your annuity will certainly grow and just how much revenue it will certainly pay.

The earnings might be available in fixed settlements over a set variety of years, repaired payments for the rest of your life or in a lump-sum repayment. Profits will certainly not be exhausted up until. (FIA) is a sort of annuity agreement designed to develop a consistent retired life revenue and permit your properties to grow tax-deferred.

This develops the potential for even more growth if the index executes welland alternatively offers security from loss due to bad index efficiency. Your annuity's interest is linked to the index's performance, your money is not directly invested in the market. This means that if the index your annuity is linked to does not do well, your annuity does not shed its worth because of market volatility.

Fixed annuities have a guaranteed minimum rates of interest so you will certainly obtain some rate of interest yearly. A fixed index annuity has a rate of interest function connected to a specified index, yet subject to a cap. If the index has negative performance, you will obtain no passion that year. Fixed annuities may have a tendency to present much less financial threat than various other sorts of annuities and investment items whose values increase and drop with the marketplace.

And with particular types of fixed annuities, like a that set rates of interest can be locked in via the whole agreement term. The rate of interest gained in a taken care of annuity isn't impacted by market fluctuations throughout of the set period. As with the majority of annuities, if you desire to take out cash from your repaired annuity earlier than set up, you'll likely sustain a fine, or surrender chargewhich occasionally can be large.

Highlighting the Key Features of Long-Term Investments Key Insights on Your Financial Future What Is Fixed Income Annuity Vs Variable Annuity? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Immediate Fixed Annuity Vs Variable Annuity Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing Variable Vs Fixed Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Choosing Between Fixed Annuity And Variable Annuity A Closer Look at How to Build a Retirement Plan

In enhancement, withdrawals made prior to age 59 might go through a 10 percent government tax obligation charge based on the fact the annuity is tax-deferred. The rate of interest, if any type of, on a set index annuity is linked to an index. Given that the rate of interest is tied to a securities market index, the interest attributed will certainly either benefit or suffer, based upon market performance.

You are trading possibly taking advantage of market increases and/or not equaling inflation. Repaired index annuities have the benefit of possibly using a higher guaranteed rates of interest when an index carries out well, and major security when the index suffers losses. In exchange for this defense versus losses, there may be a cap on the maximum earnings you can receive, or your profits might be restricted to a percentage (as an example, 70%) of the index's adjusted worth.

It commonly also has an existing rates of interest as stated by the insurance provider. Rate of interest, if any, is tied to a defined index, as much as an annual cap. A product could have an index account where rate of interest is based on how the S&P 500 Index performs, subject to an annual cap.

Interest made is reliant upon index efficiency which can be both favorably and negatively influenced. In enhancement to comprehending dealt with annuity vs. taken care of index annuity distinctions, there are a few other kinds of annuities you may want to discover before making a decision.

Table of Contents

Latest Posts

Understanding Financial Strategies A Closer Look at How Retirement Planning Works Breaking Down the Basics of Annuities Variable Vs Fixed Advantages and Disadvantages of Variable Annuities Vs Fixed An

Breaking Down Variable Annuity Vs Fixed Indexed Annuity A Closer Look at Fixed Annuity Vs Variable Annuity Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choos

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Choosing the Right Financial S

More

Latest Posts